Housing Inventory & Demographics

Nationally, the number of homes for sale is still very low. There are 33% fewer homes to purchase than in 2019.

In San Diego County, it’s even worse, Active Listings:

May 2019: 13,216

May 2024: 4,214

68% less homes to buy in San Diego County last month.

When people ask how its possible Median home prices are still rising with 7-8% interest rates, higher costs of living, or how there are still bidding wars, its because there are too many Buyers chasing too few of homes.

Why are some properties sitting? Because housing is so expensive and rates are high, so people are pickier and not buying the houses they know are undesirable for multiple factors. The irrationality of 2020-2022 has mostly abated but I still see homes that sell for premiums that don’t make much sense.

A lot of Sellers are locked in and can’t afford to move. Read about the lock in effect here:

New sales have fallen to levels seen in the 1960s - when the total US population was about 195 million; population today is about 341 million.

The lock in effect is reflected nationally with existing home sales are also lower.

Are San Diegans leaving? Some are, but housing prices are up in a lot of markets so affordability nationally is shifting. Additionally, insurance is much higher in other states, namely Texas and Florida. Insurance if you are not paying attention, is a wrecking ball for real estate.

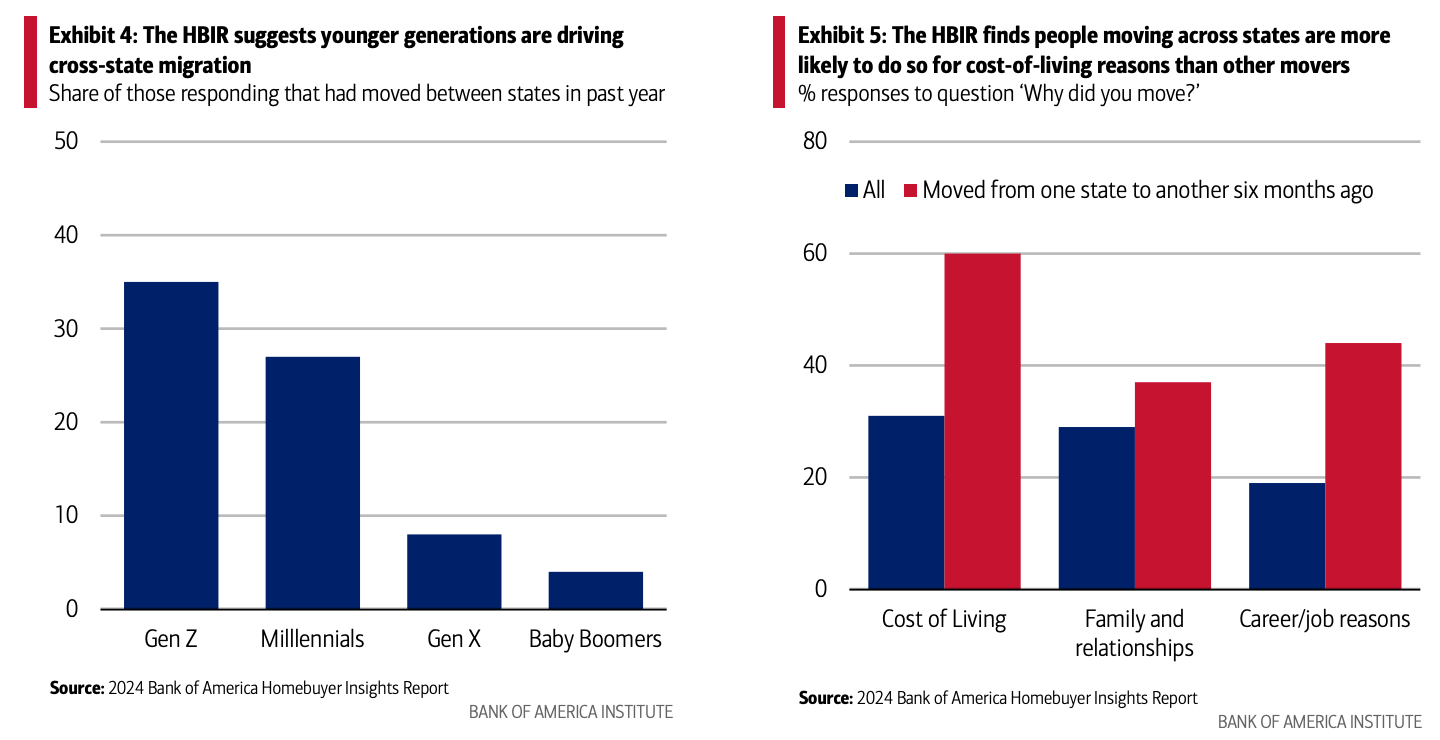

What surprised me is who is leaving. I would have expected there to be a larger exodus of younger people seeking greater affordability.

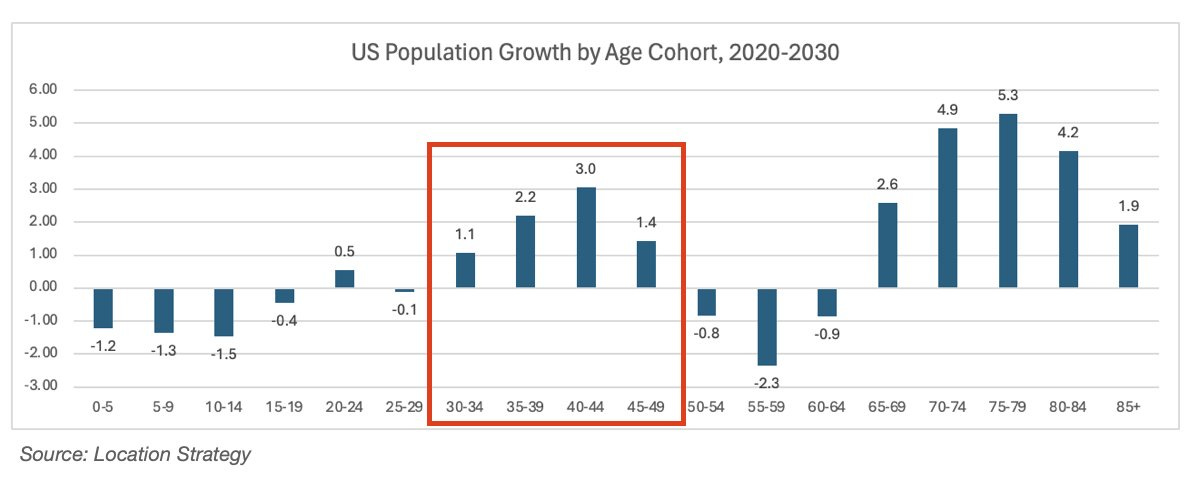

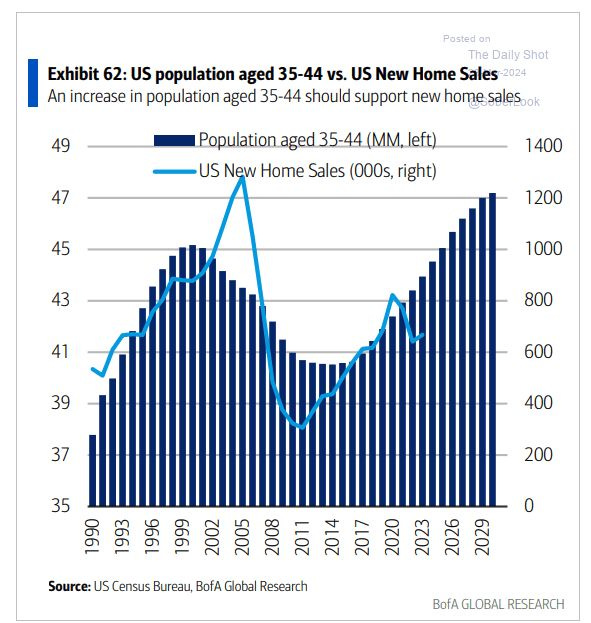

Housing has a huge demographic tailwind right now as the US is experiencing the largest wave of 30-44 year olds in its history. Historically this age group has driven new home sales growth. However due to the low supply of homes, prices and rates, this demographic is priced out.

Sample of Housing Markets I pulled to see how much Median price of homes have changed in the past 5 years. Sorted by change on the Left, and Price on the Right:

Why Is Homeownership so Appealing?

The US has created a landscape to incentivize home ownership with FHFA and the creation of GSEs to facilitate mortgage lending. For the principal & interest portion, the government has defacto created a fixed cost for homeowners on cost that is predictable. In CA, Proposition 13 further enhances this

Tax deductions

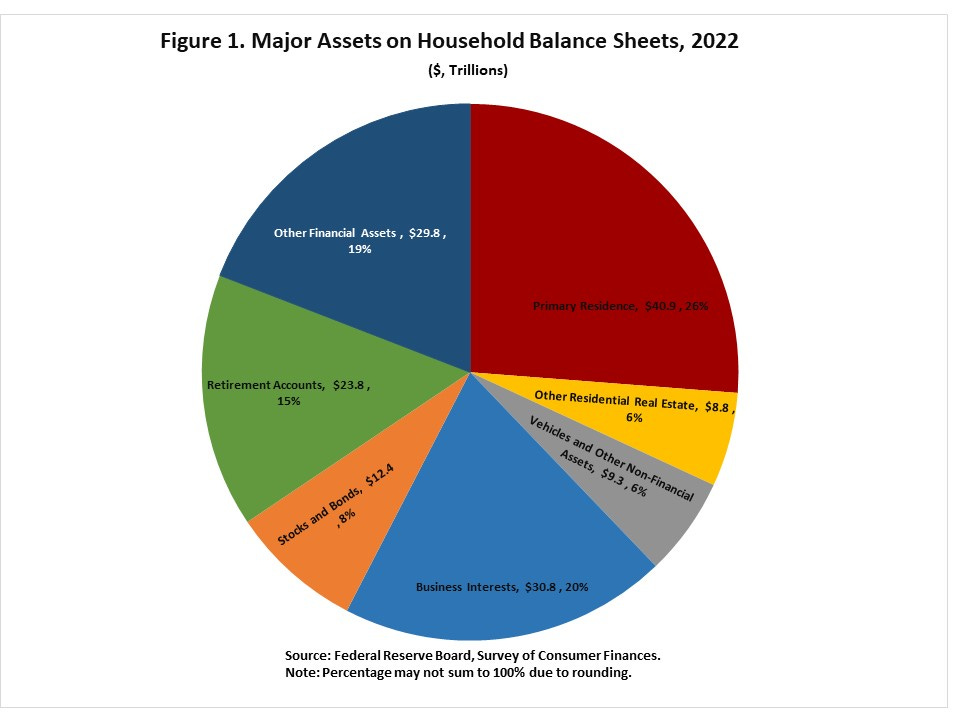

Owning assets is a hedge against inflation, the ability to build equity, and capture long term appreciation

Americans hold tremendous wealth in their primary homes