YES you CAN get mortgages when Self Employed & Retired!

FAQs & demystifying mortgages

Before you file your taxes, READ THIS!

I’m constantly reading or hearing people say its impossible, its extra hard to get a mortgage if I’m self employed, or if I’m retired.

This is just not true. But also true.

The problem is not that these loan products don’t exist, it’s that there’s a lot of bad loan officers out there. Or lazy ones who do not understand the guidelines. Or they work for a lender who doesn’t like to do those loans.

The other problem is you can’t be Self Employed, write everything off, claim no income to the IRS and then expect lenders to lend you money. Are you making money or not? Are you a successful business or losing money? You can’t have it both ways.

Just a reminder that mortgages are NOT all the same across lenders. There are many different types of lenders, there are many different types of mortgages, there are many different types of “products”. The products have different rules, costs, and how to qualify.

We can’t cover every scenario, but Matt Young, a mortgage broker with Live Better Financial, who has done 1000s of mortgages for self employed and retired clients and consistently does about 50% of his business with self employed and retirees, and he has seen and heard countless bad narratives.

However in most cases he’s able to close these loans in timeframes just like any other mortgage. In best case scenarios, he is closing loans in as short as 15 days, but 21 or 30 days are usually not a problem.

Self Employed Borrowers

FAQ 1: For all borrowers, regardless of income source, lets start with the basics of what documents you need to obtain a mortgage

A: Most commonly, the documents needed are most recent year’s W2 and two most recent paystubs. If there are other types of income being used to qualify, such as income from rental property, trusts, corporations, etc, then would need two most recent tax returns.

FAQ 2: What additional documents are reviewed if you’re self employed?

A: Self-employed people always need 2 years most recent tax returns. If their business is incorporated, then would also need the tax returns for the corporation. Additionally, a year-to-date Profit & Loss statement and Balance Sheet are typically required in order to validate that your business is still earning income at comparable or higher to the prior year’s tax return, and proof of the existence of the business via a 3rd party (411.com, state licensing agency, or CPA/tax preparer confirming self-employment).

Scenario 1: I’m self employed, I’m told I can’t qualify for a regular conforming, FHA, VA or jumbo mortgage to purchase my primary residence. I’m told I have to get a non standard mortgage that costs more.

A: So long as you have documented income, asset statements, tax returns, you should be able to qualify on your income. However, read Scenario 2 below. If you have 2 years of self employed history, you will qualify for the largest number of loan products.

Lenders will take an average of the 2 years of income as long as the most recent year the income is higher. If the income in Year 2’s tax return is lower, then they use only the most recent years income.

However if you DON’T have 2 years, there are some non-qualifying mortgage products that allow for using 12 or 24 bank statements to show self-employment income, as an alternative to using tax returns. These mortgage products have different terms as outlined in the linked article and do typically have higher mortgage rates

Tip: Before you file taxes, talk to a lender. They will explain what is typically required to qualify for a mortgage. How much you can qualify to buy based on the income on your tax returns! Yes this may mean you need to take fewer deductions if you want to qualify for a larger mortgage.

Some self-employed people will be very liberal with their business write-offs which greatly reduce the net income for the year. Qualifying income is based generally on that net figure (with some minor adjustments required by Fannie Mae or Freddie Mac). In the past, during the days/years leading up to the mortgage meltdown, business owners seemed to be VERY write-off heavy and we saw a sizable number of self-employed who couldn’t qualify that way. I have not seen this routinely be a bar to qualifying in recent years. I think this is where a lot of the misconceptions stem from.

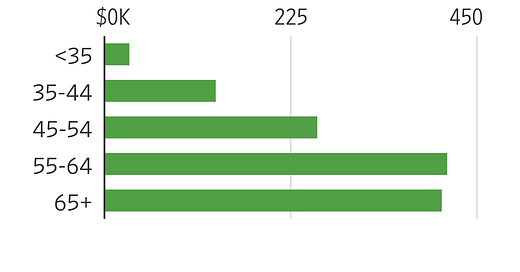

Scenario 2: Most of my income is not fixed nor consistent. Or a huge part of my comp is paid in stock. Does the non salary compensation get counted towards income for qualifying for a mortgage?

A: Every lender & investor is different. Each person’s consulting/ self employment contract would need to be reviewed by the underwriter to make this call as to whether stock bonuses valuations would come into play. Cash bonuses may be counted if they have either a 2 year history or there is guaranteed continuance. This answer also applies to W2 employees who have these variable compensation models

FAQ 3: Are mortgage rates higher for self employed or retired people than W2 workers?

A: No change to rate so as long as the borrower qualifies for a FHA, VA, conventional or jumbo mortgage product. Rate is based on property type, FICO score, Loan-to-value (i.e. down payment), and occupancy type

Again, non QM mortgages can be available and those do tend to carry higher rates and different terms.

Retired borrowers

FAQ1: How do I qualify for a mortgage, refinance or home equity line if I’m no longer working?

A: Most retired borrowers have no employment income, so these borrowers typically will have Pension income, social security income, or retirement/IRA distribution income.

Many retired people have no need to take IRA distributions as their lifestyle is very modest.

Scenario 1: I have a lot of money in retirement assets (such as an IRA)- how does this help?

In the event that they suddenly decide to upgrade to a bigger home or need more income to qualify, lending guidelines allow borrowers with retirement accounts who are of retirement age (62 or older), to begin a monthly distribution and we can use that income with documented proof of at least one distribution being deposited into their personal account AND there is a sufficient retirement account balance to allow for 36 distributions or more to be made.

You do not need to take the 36 distributions in practical terms. This a paper math based calculation to determine if you have enough income to qualify. You must show evidence of at least 1 distribution, but you do not want to take this until you are in escrow unless you plan to take distributions routinely.

For example: in addition to your social security or pension income, etc, you are short by $2000 a month in income to qualify for the mortgage amount you desire to take.

You have $300,000 in your IRA, if you are willing to take a 1 time $2000 distribution in the month you are in escrow, then you can use this income to qualify.

Why? $2000 x 36 months = $72,000. Of which you have $300,000 so this demonstrates your ability to repay as per the loan guideline.

FAQ 2: Will the mortgage rate be higher because of the type of income for Scenario 1?

A: No, income is income

Scenario 2: If you do not have significant retirement assets, but do have a lot of liquid cash, then what is my mortgage option? For example, you just Sold a house, have a lot of cash from the proceeds, but do not want to put all of it towards the new home. Can I borrow against it?

A: A lesser used option that is available to retired and non-retired borrowers alike is asset depletion, where as asset account is divided up over a period of months and is able to be added to the income total. These loans are going to be Jumbo or non-qualified mortgage options, and not Fannie Mae or Freddie Mac conforming loan programs. This generally means a little higher rate (though not always) than a conforming loan option.

FAQ3: Why would I take a traditional mortgage in a refinance vs doing a reverse mortgage if I own the home?

A: A regular forward mortgage is generally a lower cost and rate vs a reverse mortgage and will preserve the equity in the home.

Some borrowers opt for reverse mortgages, which allows the borrower to live in the home with the interest being tacked on to the loan balance, essentially using their equity to make the house payment for them. This is good in situations where they would like more cashflow to live, for example if they need to hire in-home care, etc, and won’t likely be selling and moving to a new home, and aren’t concerned about the amount of equity being left to their heirs. Reverse mortgages are heavily insured and the heirs will never have any obligation in the event the property is worth less than the total amount owed.

FAQ4: What are the cons of reverse mortgages?

A: Some loan officers may charge predatory fees. While origination fees are capped, a predatory loan officer can play with the mortgage rate offered to you to increase their compensation. For example, let’s say the prevailing rate is 7%. A lender can offer you the reverse mortgage at 9% which allows them to earn more compensation. This is not a scenario available in conventional mortgages

You are accruing interest, at higher than forward mortgages, and those costs are eating into your equity. If you ever need to Sell your home and move into assisted living, there may be little to no equity left on your home.

A condition of reverse mortgages is you must stay on top of payments for property taxes and insurance. If you fall behind, the mortgage servicer can start foreclosing on the property

If you die, and there is significant equity in your home, the reverse mortgage must be paid off in entirety very shortly. This timing may be extended if the heirs are selling the home. Check with the reverse mortgage servicer.

NOTE: This is highly generalized scenarios. There are so many specific scenarios that apply to Borrowers including whether or not they are foreign national, credit scores, loan type. Please consult a loan officer experienced in working with your mortgage need!

How Do I Find the Right Loan Officer who can do these Loans?

Start here- FAQs on how to find a great Loan Officer

Red flags:

Every loan officer/ lender should be able to do these loans. There are Fannie Mae and Freddie Mac guidelines which govern and specifically allows for Self Employed Borrowers and Retiree Borrowers. So if they say they don’t know how, don’t do them, or do not do them commonly, RUN!

If you get a No before the loan officer as fully reviewed all of your financials, tax returns, etc. Move and call other Lenders

If the loan officer is NOT responsive or is taking too long. In most scenarios, Young says he can review a Borrowers documentation within the calendar day. In more complex or challenging scenarios where he needs to run it by an underwriter it can be 1-3 business days depending on how complex the scenario