The housing market is soft. What does this mean?

It means that we are largely back to non irrational conditions. That properties with multiple negative immutable factors, that are priced incorrectly sit and chase the market down. This doesn’t mean that really desirable homes in really desirable locations aren’t still selling well. Those homes sell well in any market- I saw this firsthand after the Great Financial Crisis.

Mortgage rates continue to stay high. There is a lot of fear in the market. Condos have gotten hammered between decades of negligence by poor stewards of a building/complex that have come to a head forced by insurability and lendability as well as the structural laws that went into effect in January. This has led to special assessments to fix decades of deferred maintenance of safety issues, structural issues, fire risk from known electric panel issues, high fire risk abatement and a rise in HOA dues. This is why I’ve been saying low HOA fees are inherently bad. You need time to build reserves for future major repairs and issues. With low reserves, many condo associations have lost their ability to be FHA or VA loan eligible. Master insurance policies have been getting dropped as well.

Fire risk and insurability is a big factor for all types of property. As I’ve written about in past posts, just because you have State Farm, AAA, USAA, Allstate insurance today, it does not mean the next Buyer can get insurance. Several of these insurers have stopped writing new policies in CA entirely. If CA Fair is the only insurance available to you, this means that the cost of insurance is dictated to you if you need a mortgage as you are required to carry homeowners insurance. CA Fair only covers fire and a wrap policy is required and often offer lower limits on coverage for other non fire related calamity.

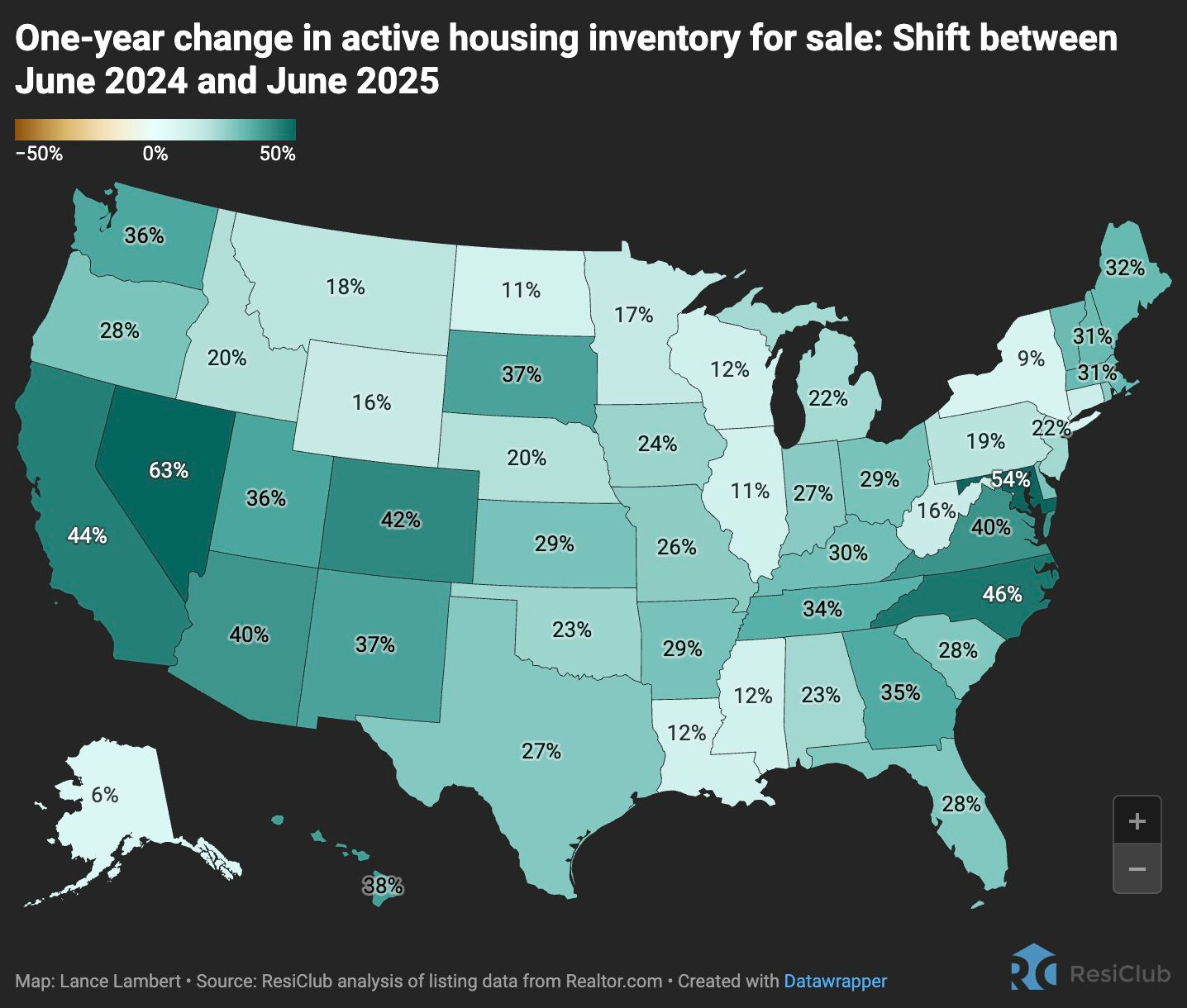

As a result we are seeing inventory climb. Inventory is supply and demand measured in months of inventory. If there are 9 homes on the market in your area, 3 homes sell per month, then it will take 3 months to sell through 9 homes. Anything 3 months or below is a Sellers market, above it is balanced to favoring Buyers (Buyers typically do not have to buy or can wait, vs some Sellers have to sell and on a timeline) and once you get above 5-6 months you are solidly in a Strong Buyers market.

Detached is just above 3 months and Attached is around 4 months of inventory.

If you are an actual real motivated Seller vs someone fishing to cash in at a high price, then you need to price the home strategically below market to drive demand and not appear as a greedy Seller. If you watch the market you will see a ton of homes sit and drop the price. Pricing low, preparing the property for a wow factor are critical to driving demand and getting more people to view the property and more Buyers to write offers. Creating a competitive multi offer scenario is still possible especially if the home is attractive for reasons that are scarce. For example, 1 story Detached homes without HOA fees are rare in North County. Or if you own a impeccably maintained older home with architectural desirability such as Spanish or Craftsmen details or is historically designated.

Sales are down even seasonally the past several years.

Remember when you look at housing charts that this data is highly conflated meaning you do not know if larger more expensive homes are selling, cheaper less expensive homes, great condition, bad condition so the details get lost.

If you are however following a specific market then you will know exactly what I’m talking about in the tide shift in market demand as well as the volume of price reductions.

Take this Detached Carlsbad home for example, multiple price reductions, listed/re-listed and in escrow more than once.

Even in properties that get multiple offers, sell for over ask, sometimes significantly, we are seeing a lot of concessions. As a Seller you need to be reasonable as to condition and the value of your home. Your home is likely NOT worth what someone would have paid for it top dollar in 2021 and even if they do, they will be less tolerant to end of life condition systems or problems that are discovered during investigations.

If a Buyer has a mortgage, they can only take a credit to the max of their actual recurring and non recurring closing costs which includes items such as title, escrow, lender fees, VA or FHA funding fees, prepaid interest, insurance, prepaid prorated property taxes, rate buy down, impound accounts, etc. The rest must be taking in the form of a price reduction.

Here’s a sample of some homes that sold in various zip codes that offered concessions in the past 30 days. Keep in mind this is user inputted so there are likely more homes offering concessions but not noted in the MLS. Also the Original Price reflects the actual listing at the time it was Sold and doesn’t track the property cumulatively if it was listed/unlisted/relisted as it generates a new MLS number with each listing and reset the statistics in the MLS.

On the lower end, we are seeing a lot of Buyers marginally qualify and need help in order to qualify. When I say marginally qualify, I mean they are above 50% Debt to Income (on gross income, all debts), they have little cash and need down payment or closing cost help to even buy the house they’re writing an offer on. They don’t have more cash to replace the roof or fix a major problem.