Purgatory- this is how I’ve been describing the housing market in San Diego. There is a spread in price & expectations between Sellers & Buyers.

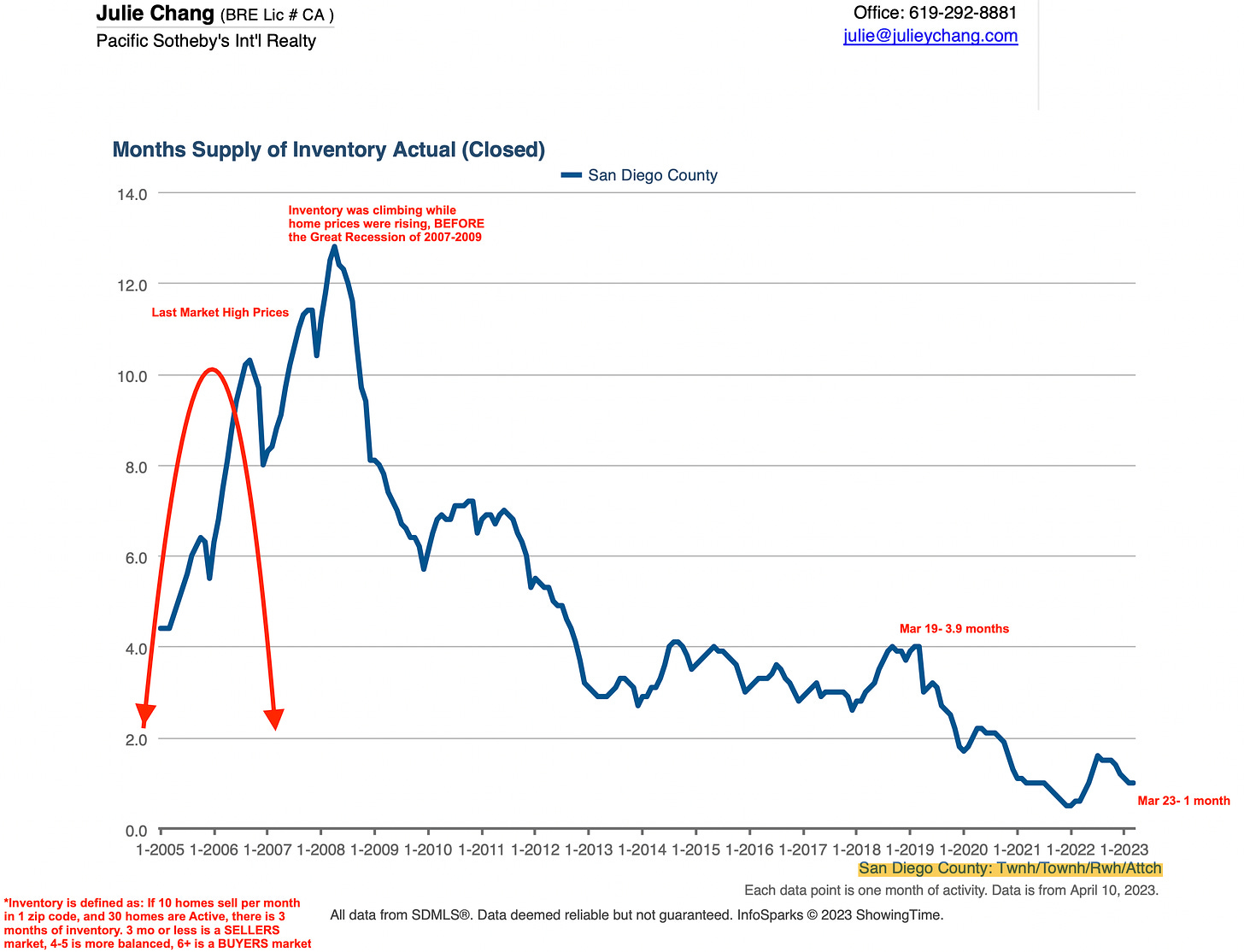

Many of us were waiting to see if the usual “Spring” selling season was delayed due to all the rain. Normally by the end of January, early February more listings come on the market. This year the number of properties on the market has been anemic.

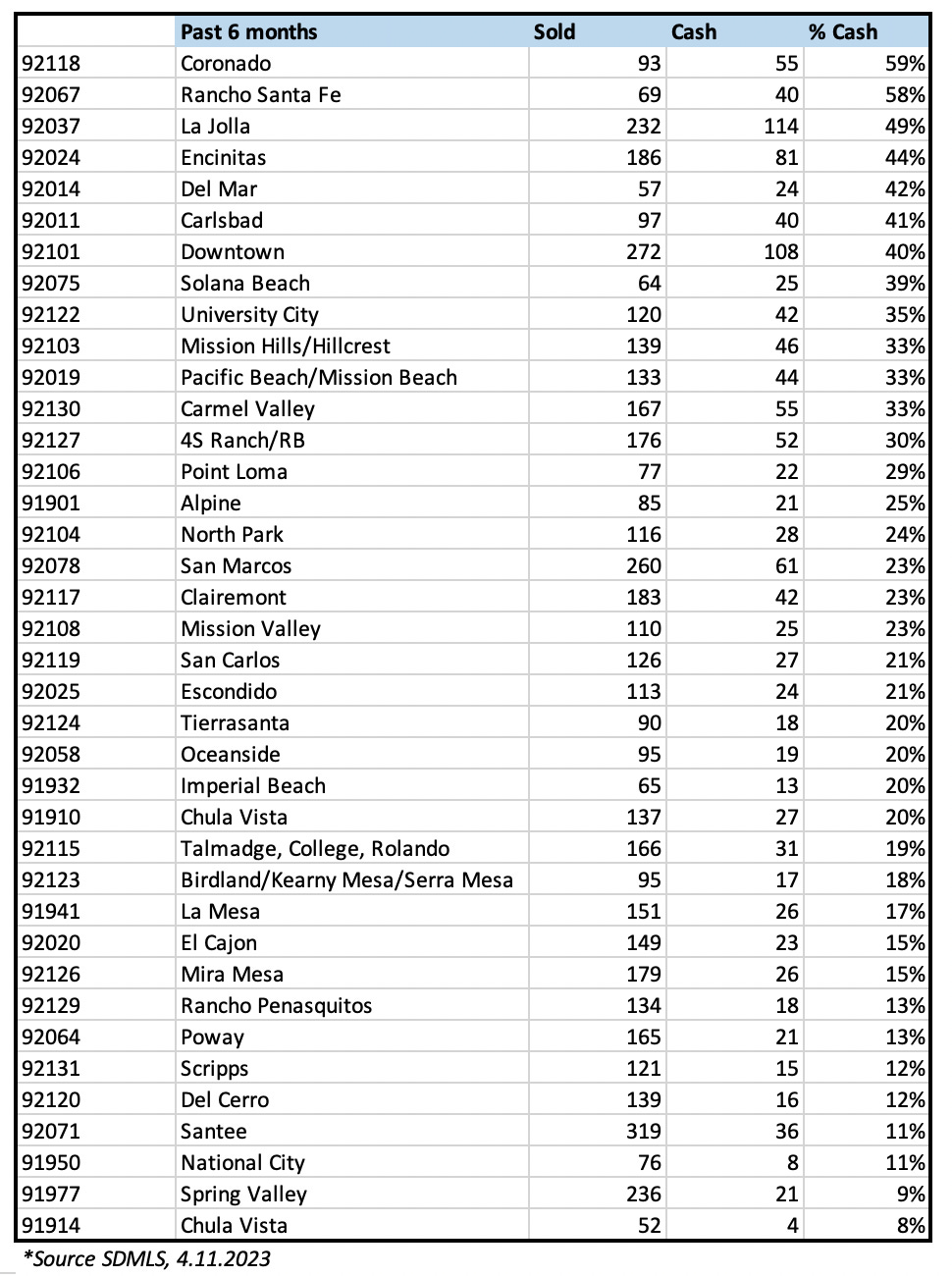

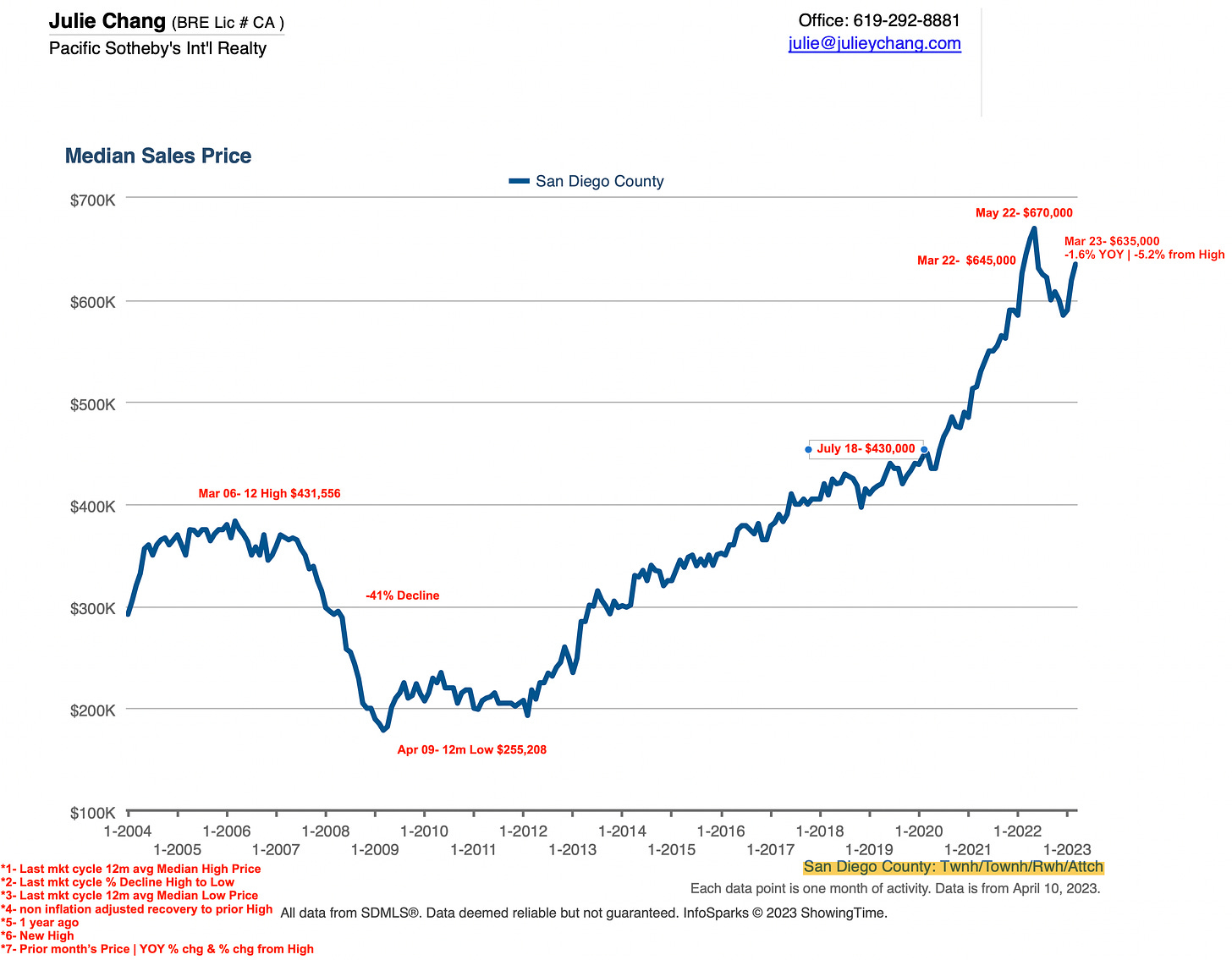

Residential housing prices are flat YOY & down slightly from the peak. I wouldn’t read too much into one month vs next data to try to suss out a trend in any given zip code. There have been few sales, variances in size, condition, style, location, motivation of the Seller/Buyer can explain the up/down tick.

Properties that are highly updated in great locations are still selling well, often with multiple offers, some over ask. Often these are homes that are unique- not tract and there are very few alternatives in the neighborhood or zip code. Properties priced too high, in a poor location, have a number of negative immutable factors are sitting longer and often going through multiple price reductions.

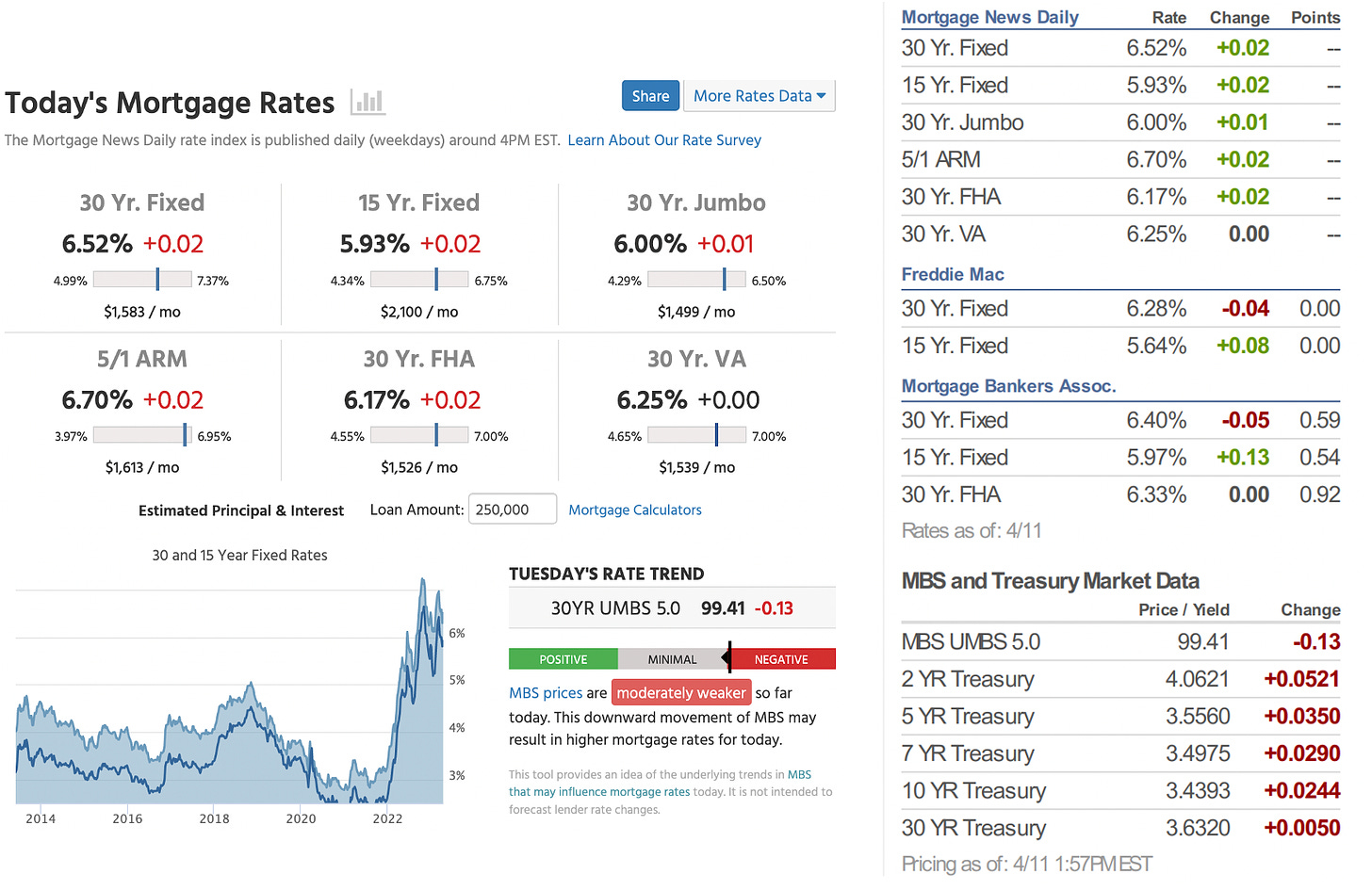

There continues to be a lot of cash in the market. Would it surprise you some zip codes are seeing 30-40% cash buyers out of total sales in the past 6 months?

See sampling of zip codes in the County of total sales in the past 6 months, number & percentage of cash

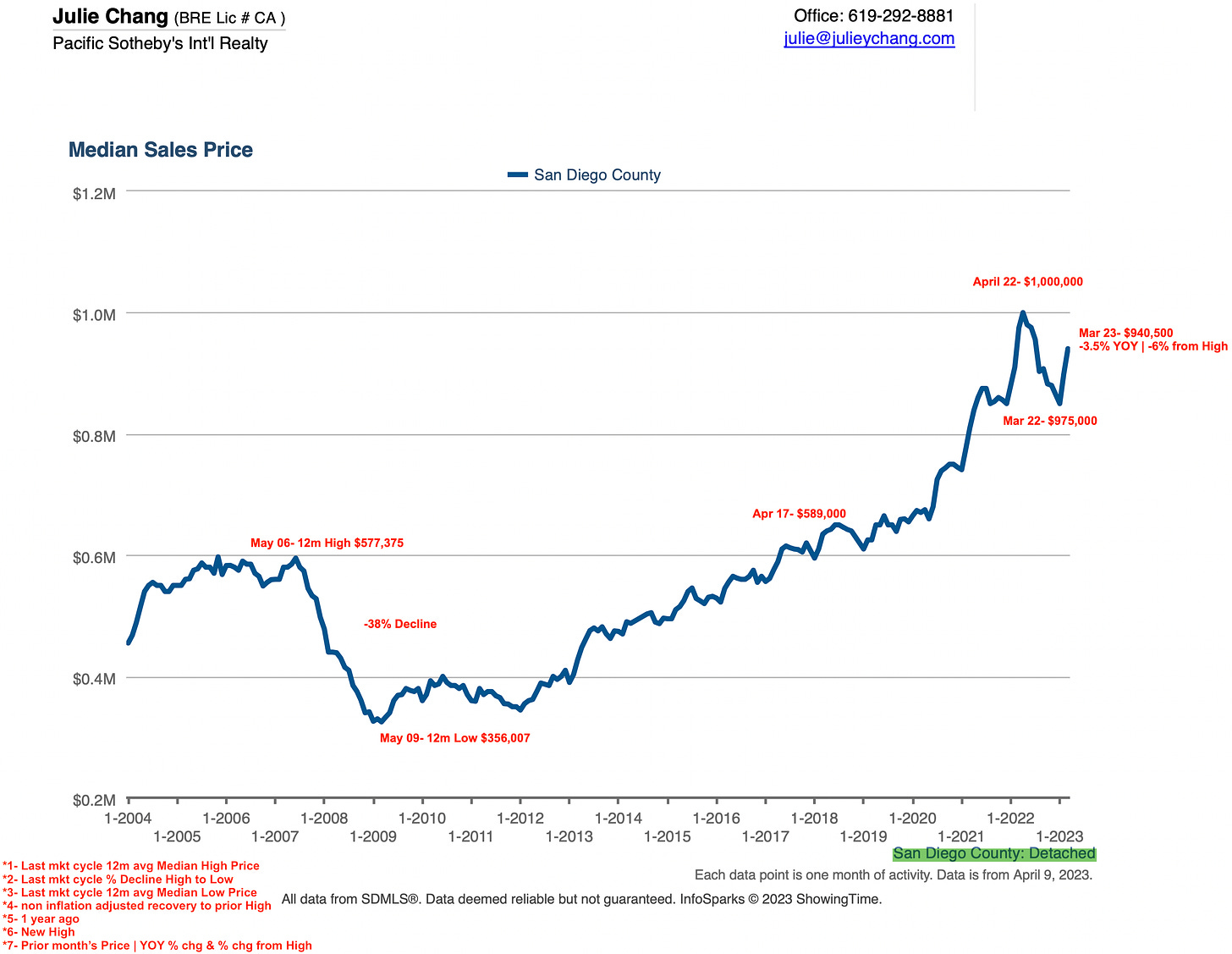

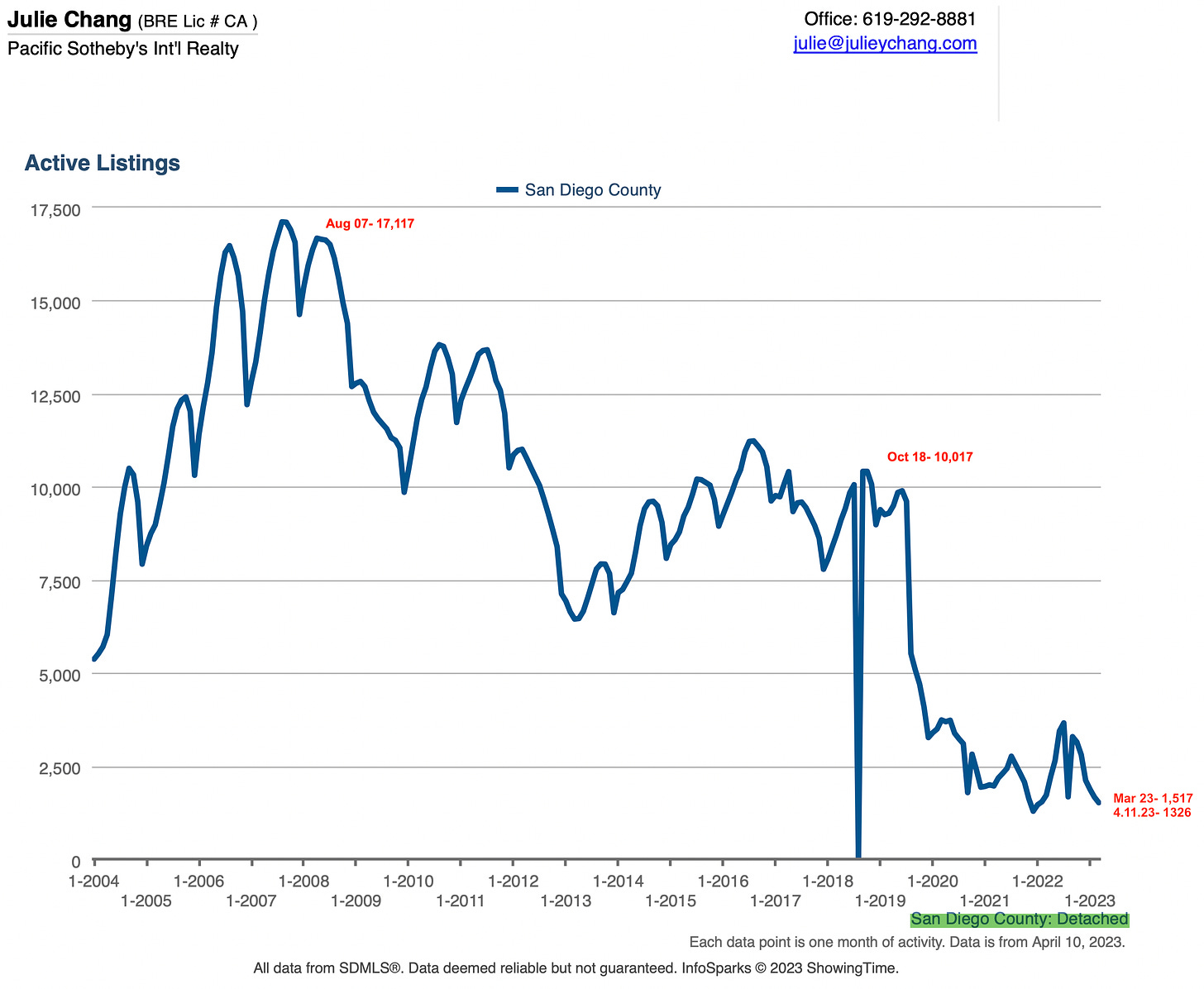

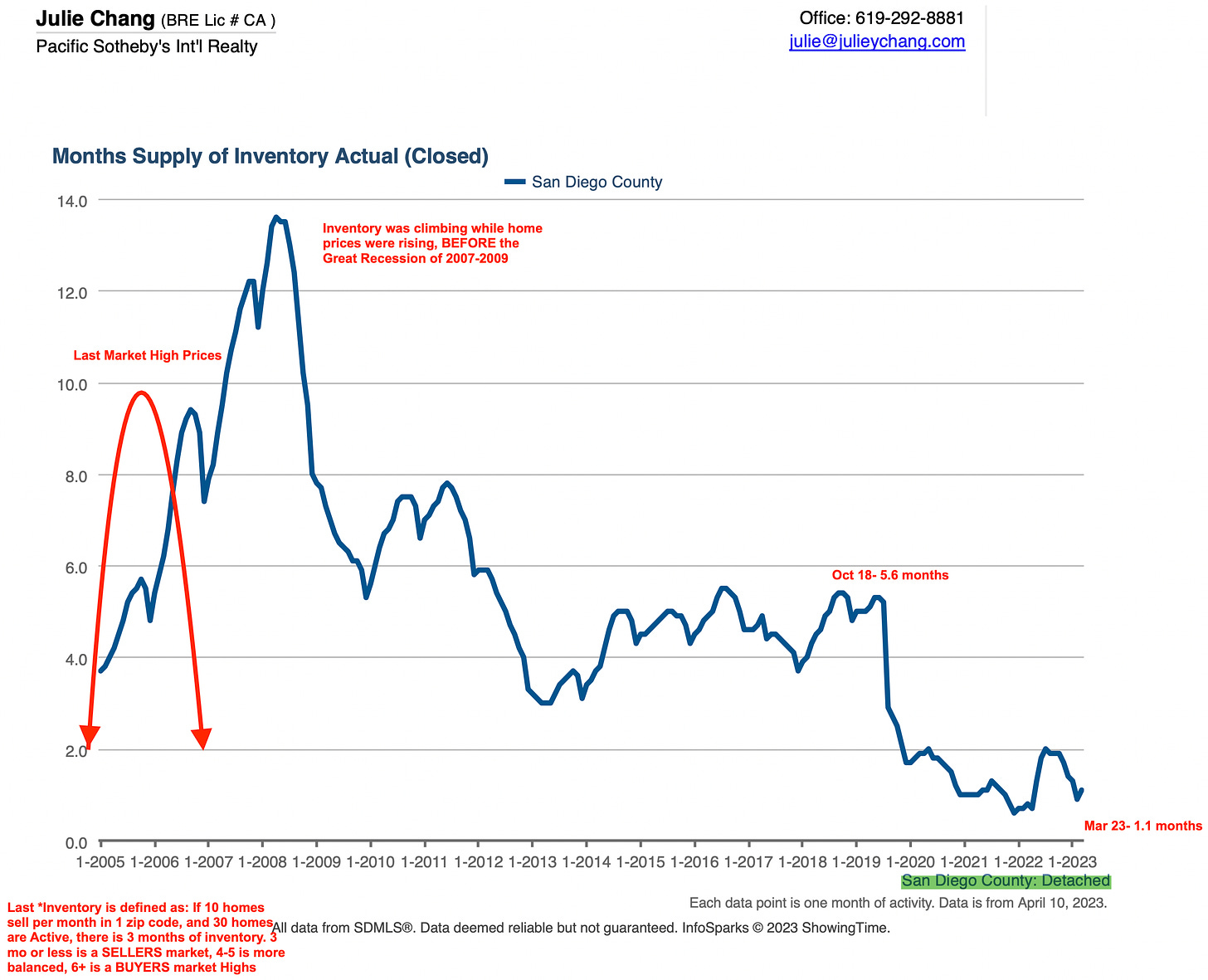

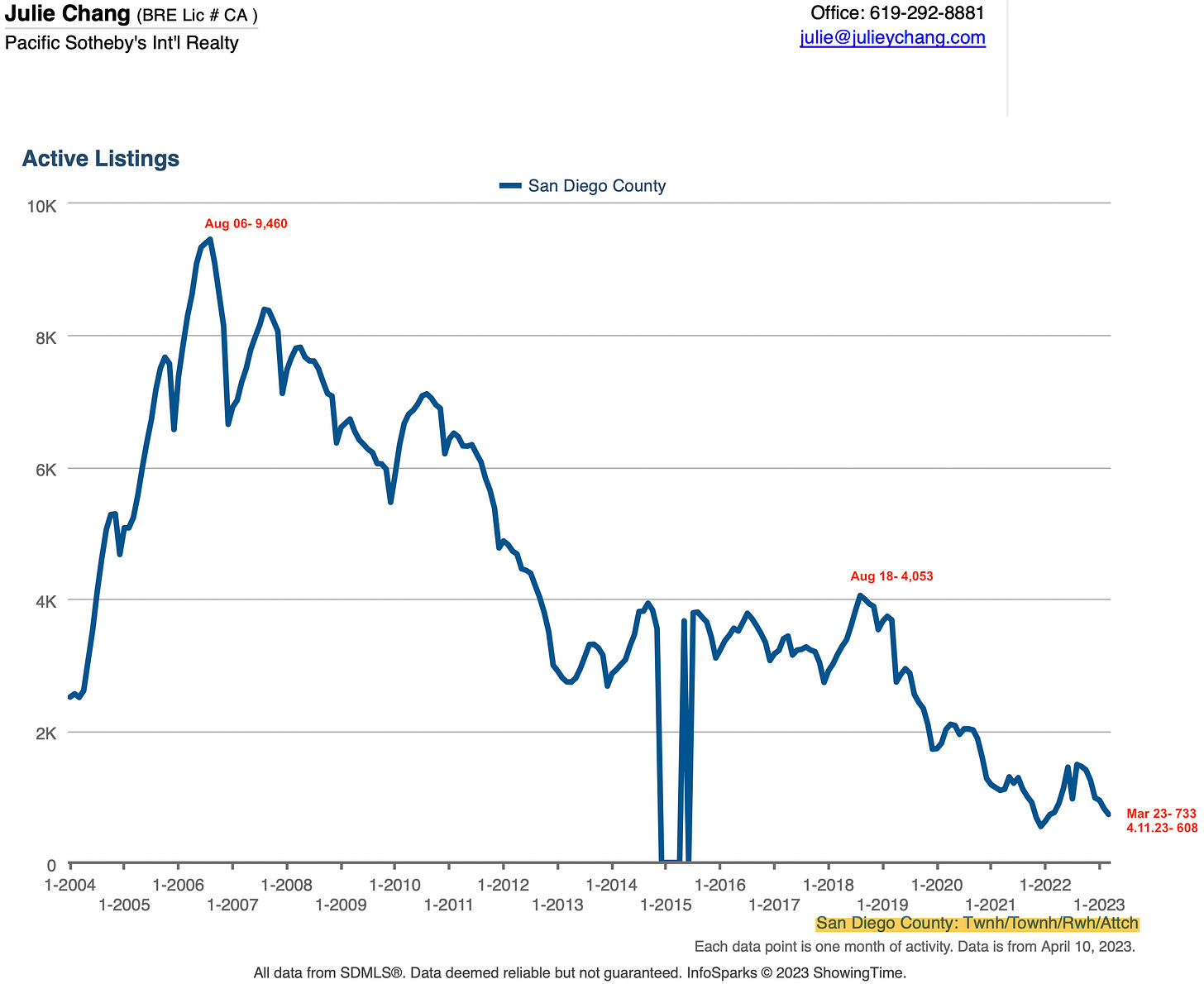

Median Price, Active & Month of Inventory for San Diego County - Month ending Mar 2023

Detached

Attached

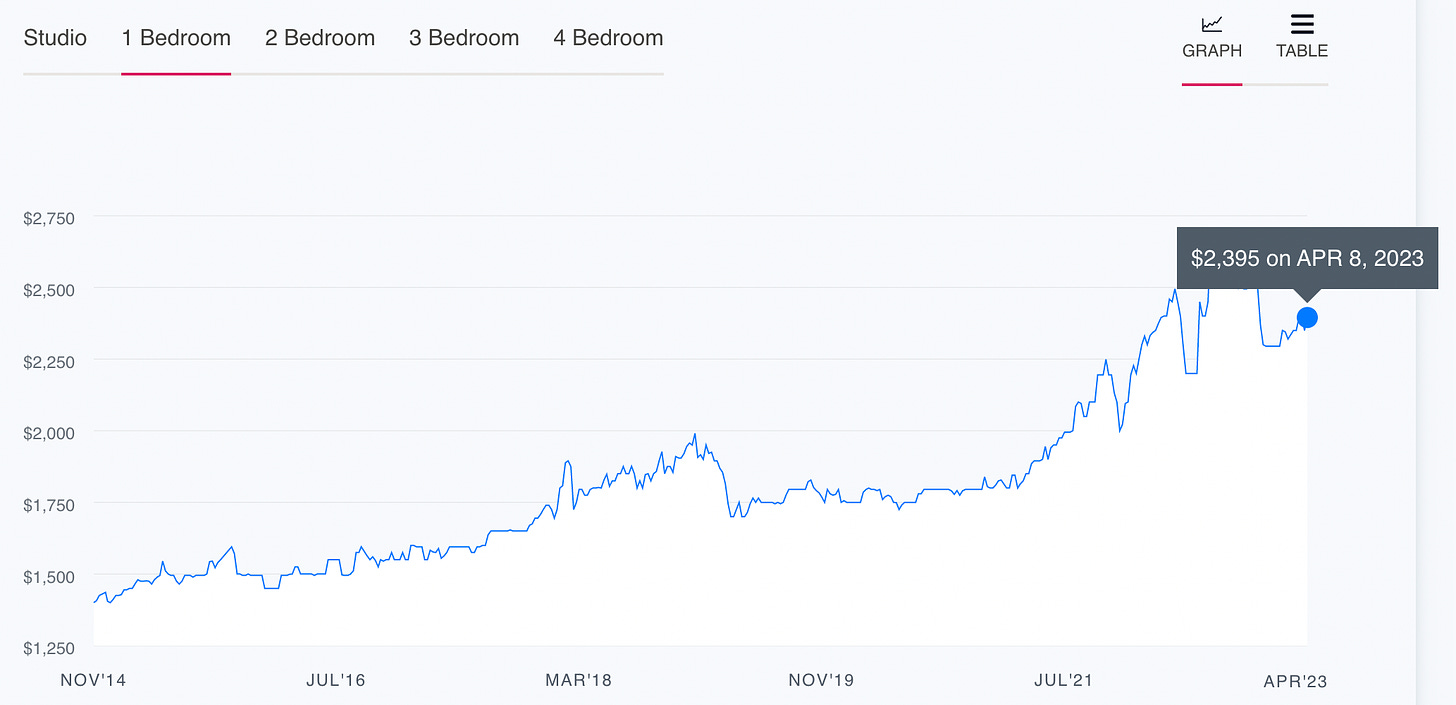

Rents are slightly up from last year.

5+ units continue to be marketed with mostly sub 5% cap rates, many units with under market rents, the properties do not cash flow without significant equity to meet DSCR. Properties in bonus density areas are attracting multiple offers where there is an opportunity to bring way under market rents up, convert garages to ADUs or to re-develop the lots.

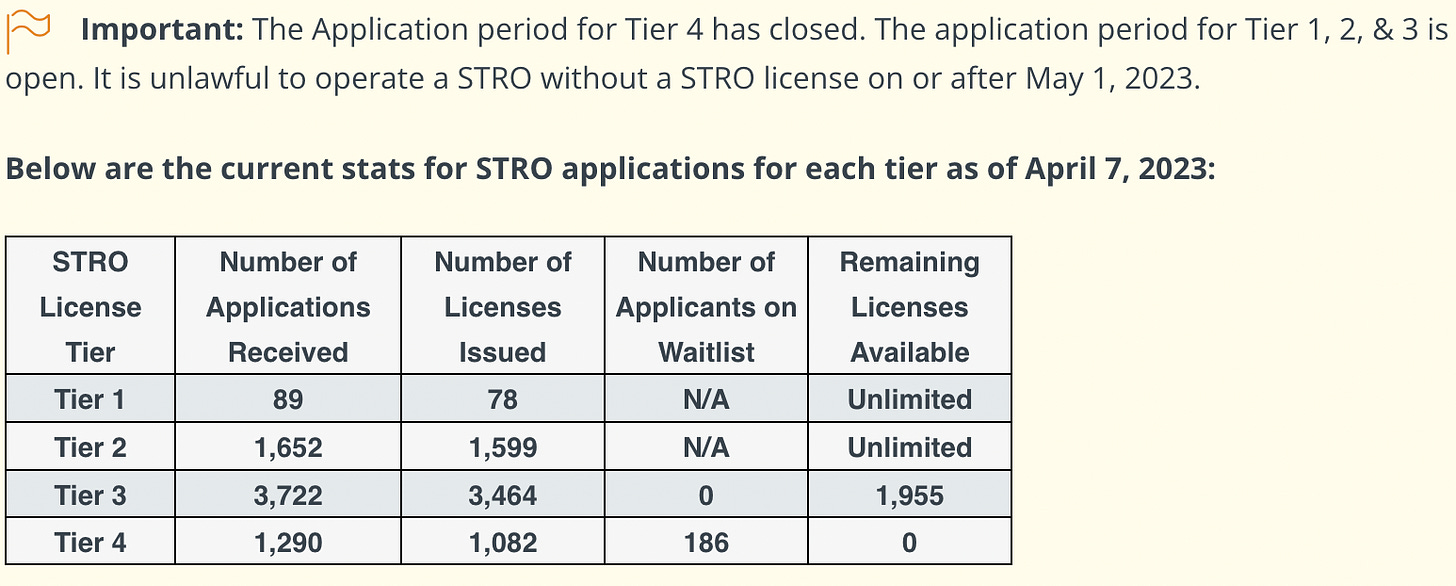

Short Term Rentals: As of May 1, 2023, it is unlawful to operate a STR in the City of San Diego without a STR license. Surprisingly there are still Tier 3 licenses available as of 4.7.2023

Rates continue to be volatile. Credit contraction is for now impacting commercial more than residential (5+ units residential to strip malls, industrial, office). Bridge & construction debt is the most impacted.