Here’s a roundup of notable news that is impacting housing / real estate:

State Farm is the latest in insurers to announce they are stopping all new homeowners insurance policies in CA. Existing policies will continue but cease if the policy is cancelled by that policyholder. AllState already stopped last year. Farmers Insurance announces no new policies for Florida

this is going to impact your purchase or sale if the only options are CA Fair and the costs are exorbitant. Please know CA Fair only covers fire, you’ll need a separate policy for everything else

If you already have State Farm for the home, State Farm is not writing any new policies, so the home is not grandfathered and State Farm will not offer insurance on your next property

CEA announces changes for earthquake policies. If your home is on a raised foundation or over $1M in particular, this really impacts your insurance coverage

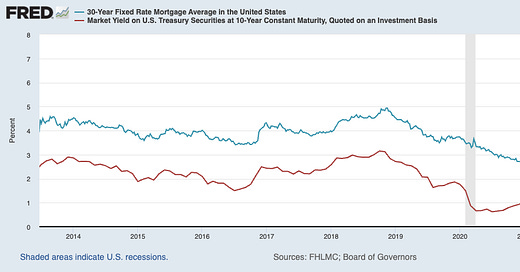

Jerome Powell affirms in the Monetary Policy Report this week, the plan to continue QT (quantitative tightening) with around 1T rolling off the balance sheet annually. This may be 1 reason yields are staying high. Additionally, confirms the Fed is considering more hikes to the Fed Funds rate- the only rate the Fed sets

The spread between the 30 year mortgage and the 10 Year Treasury continues to stay wide at over 300 basis points, possibly reflecting duration risk. Duration risk is the notion that the mortgage will be refinanced in the near term

San Diego rents are at new record highs in June. This means 2 things to me, for people struggling to save, this means even less savings for a down payment to buy. However for people who have a down payment saved, and have been on the sidelines considering buying, buying may become more compelling as higher rents may be the tipping point.

Dallas bans STR (short term rentals) in single family homes. If you are buying income property in San Diego to STR, run the numbers and consider the implications if you can no longer STR, or the restrictions become unprofitable. Does your investment still work with MTR or LTR?

Much of the distress in real estate news continues to be in CRE (commercial). 5+ units in residential housing falls under commercial lending and has different lending underwriting governed by DSCR (debt service coverage ratio).

Some multi family properties will be forced sales due to inability to refinance due to maturity, or due to rate resets

The construction & multi family loan market is very challenging and is going to impact new housing starts which leads to continued strained supply, high/higher rents and housing prices. On properties with deferred maintenance, the property conditions may continue to deteriorate

Multi family transaction volume is down 83% in Q1 of 2023