2024 is on track to have the LOWEST number of homes sales since 1995.

U.S. home sales fell in August and marked the fifth time sales have declined over the past six months.

Fannie Mae's chief economist Doug Duncan is ready call it : "Full-year 2024 will produce the fewest existing home sales since 1995" Duncan said.

Sales of single-family, condo and cooperative homes dipped 2.5% from July, the National Association of Realtors said. The number of existing houses sold, seasonally adjusted on an annual basis, was 3.86 million in August, the lowest for that month since 2010.

The market is soft in San Diego. Every agent I speak to echoes this. This doesn’t mean that there aren’t still homes selling over ask, with multiple offers. It just means that we are experiencing more normal market conditions, but in other respects, the market reflects Buyers who have chosen to take a break, given up, priced out, or are just waiting. The ones who are Buying know the market is softer and are no longer capitulating to Sellers like they were a few years ago. In some price points however, particularly in single family under $1.2M, the market is still very tight.

A lot Sellers just aren’t motivated to Sell or can’t afford to move. The lock in effect still persists

Since the Fed cut the Fed Funds Rate on Sept 18, the 10 Yr Treasury and 30 Yr mortgage rates have been moving in the wrong direction.

While prices are down marginally, remember the data gets highly conflated. Median prices reflect a combination of all homes that sell, with the details of condition, location, size, desirability lost.

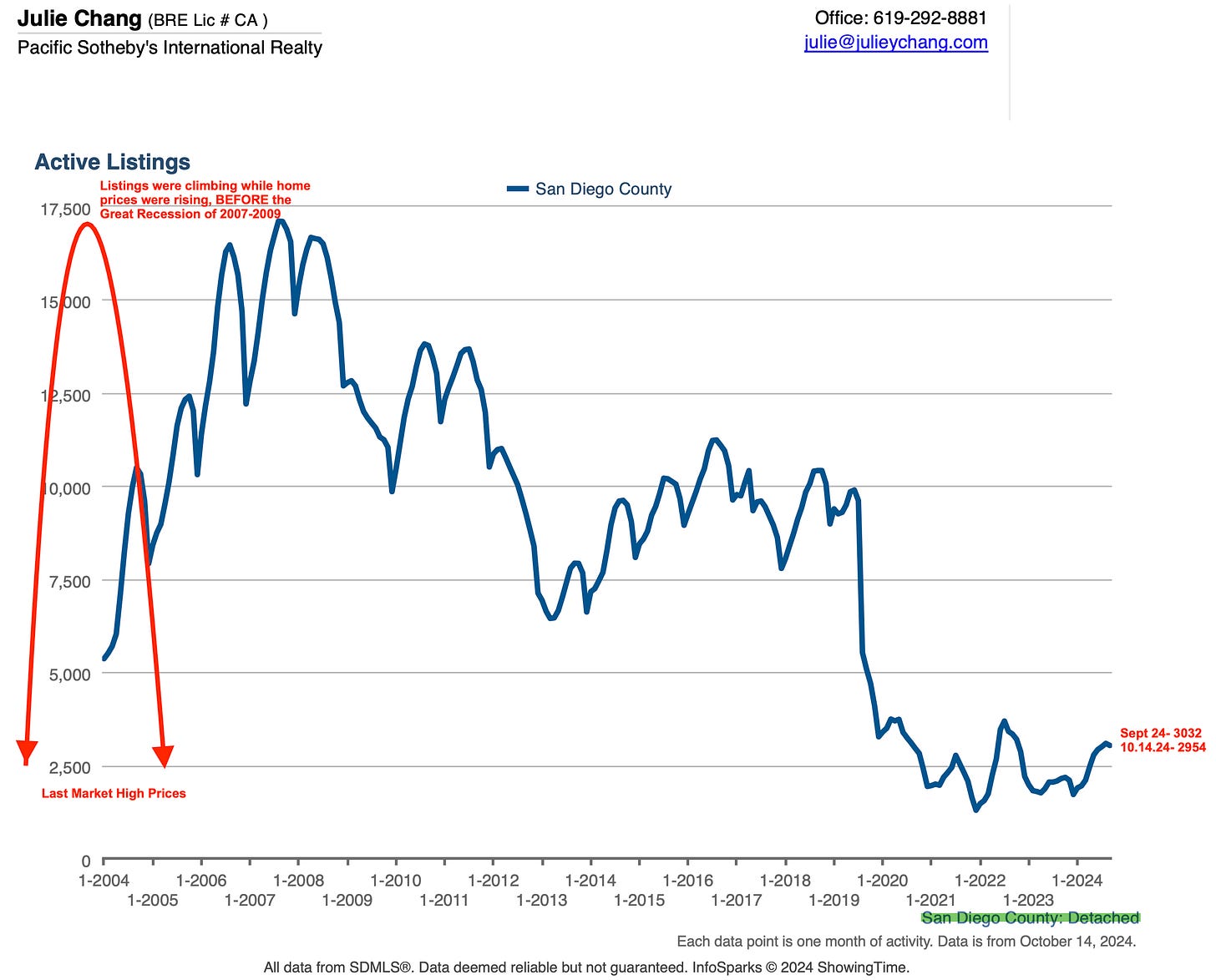

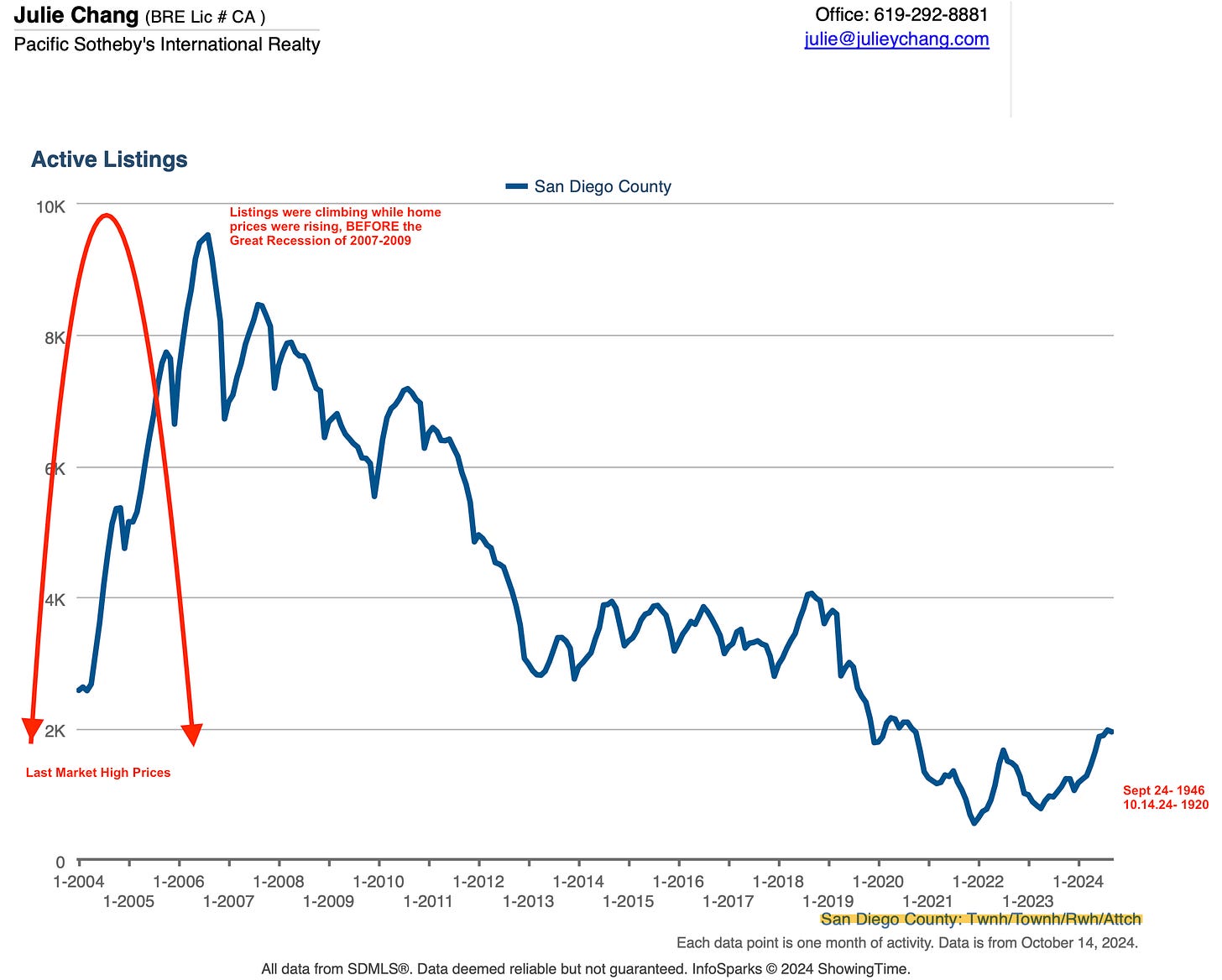

Active Listings have increased, but are still very very low.

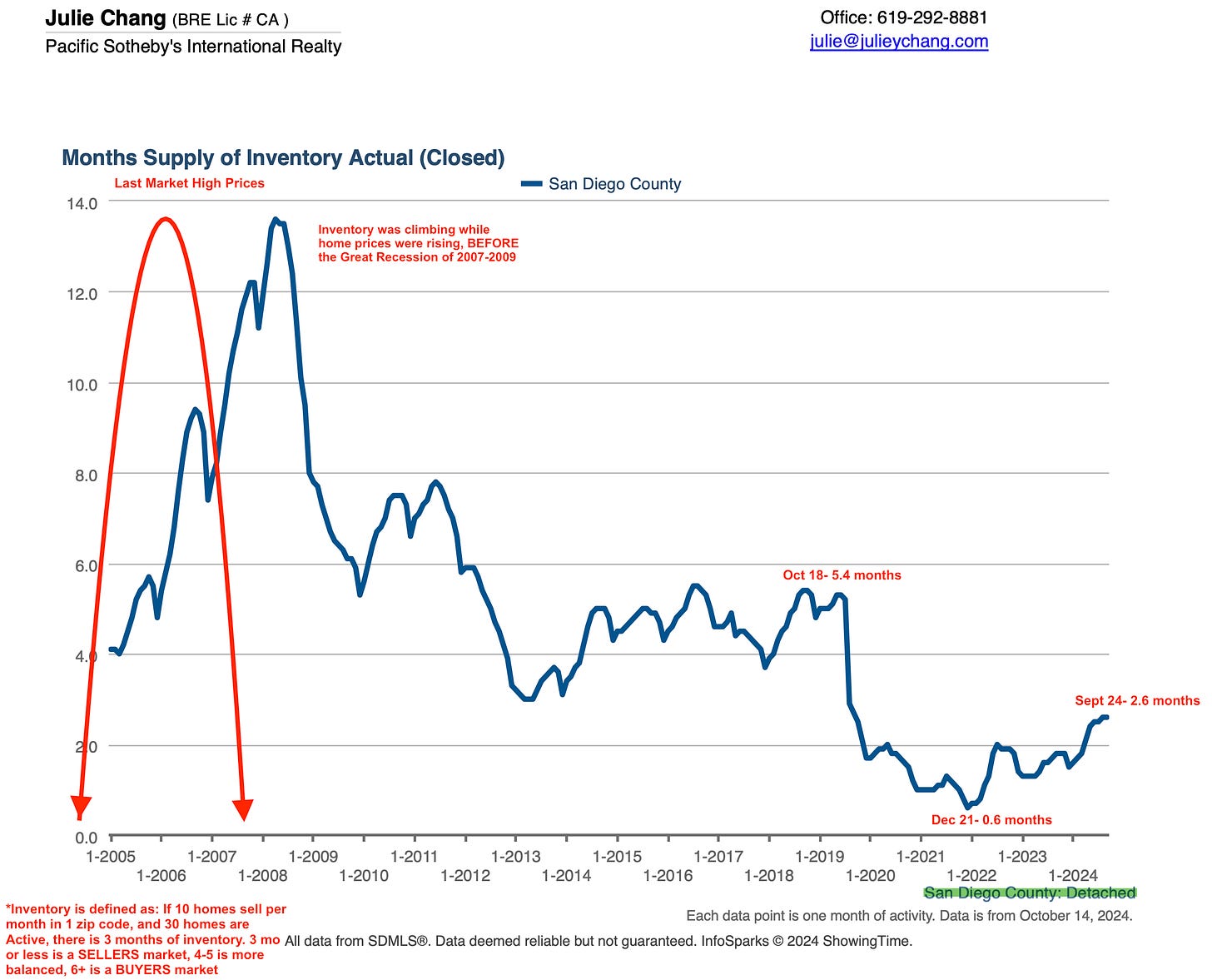

Months of Inventory reflects BOTH supply and demand. Demand has definitely softened as the months of inventory creep up.

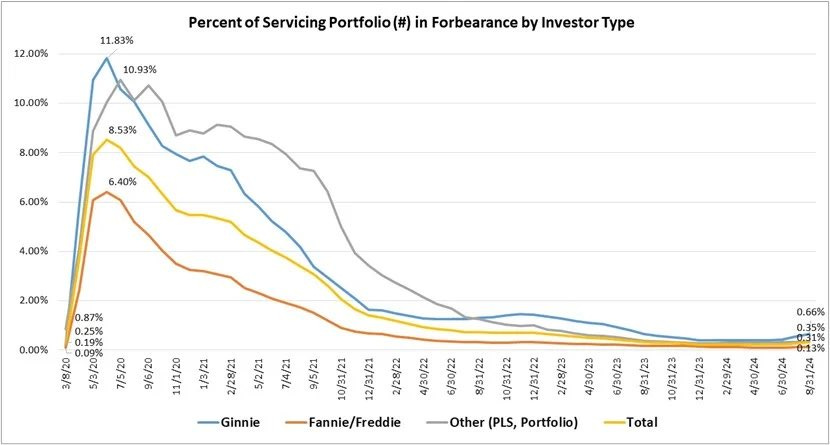

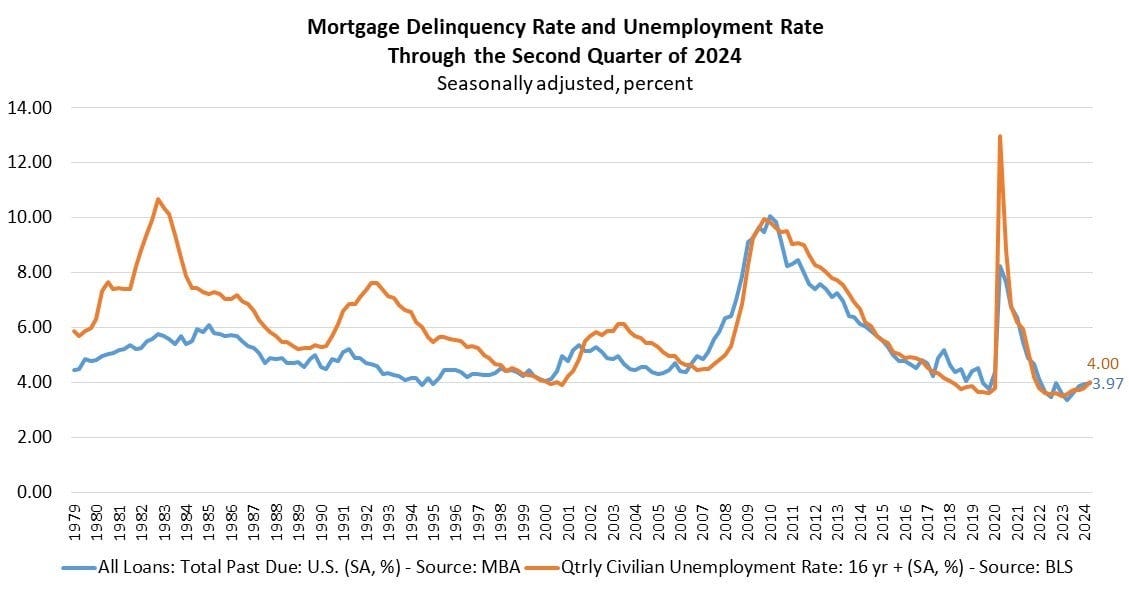

We are seeing fewer showings, Buyers being very picky but Sellers aren’t capitulating the way Buyers are hoping they will. In large part this is due to a lack of widespread distress and lack of supply. In absolute terms of Active listings, we still do not see a lot of buy. Mortgage delinquency and foreclosure rates are low.

Let’s take a look at some examples of homes that are sitting longer.

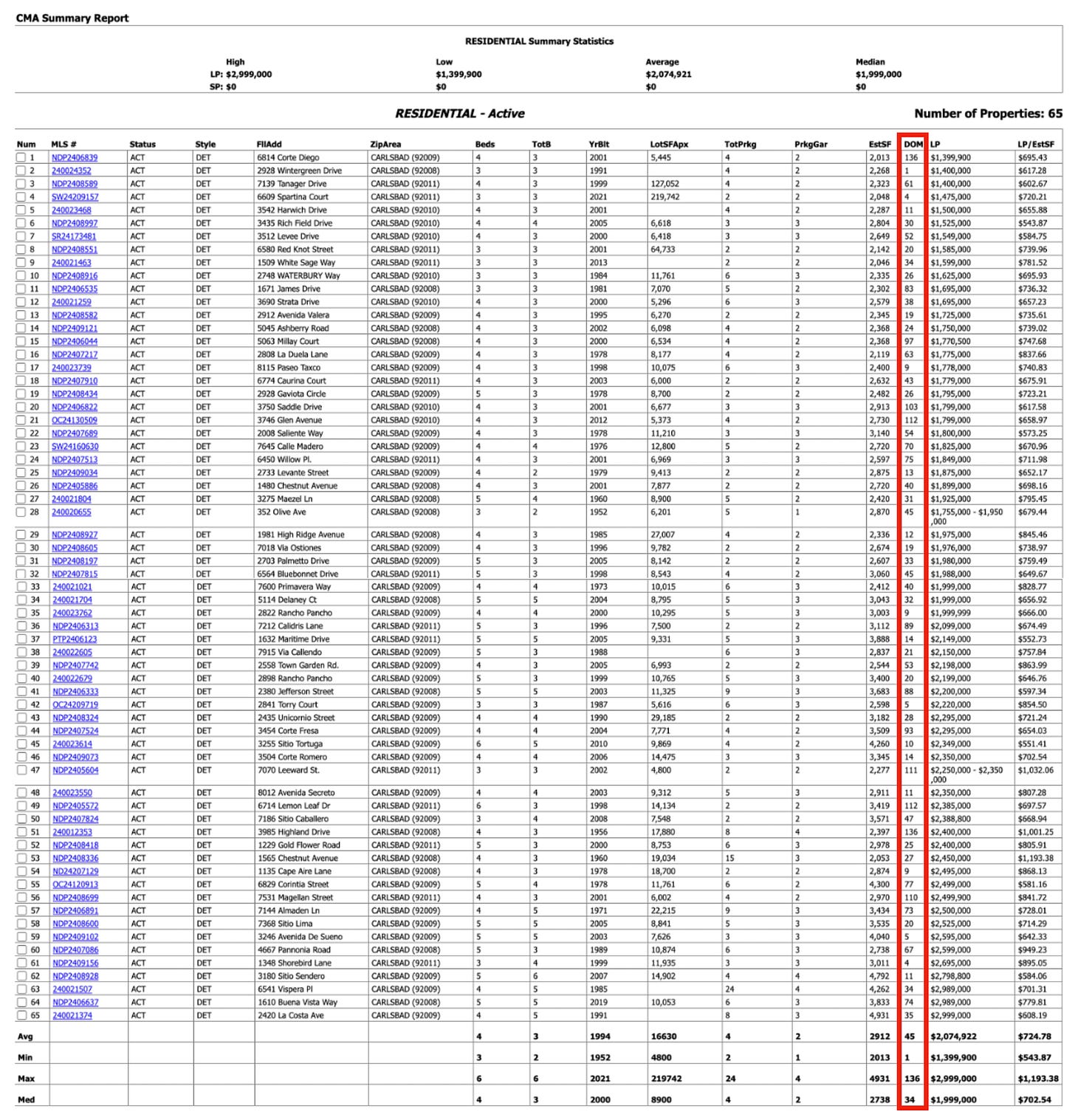

Carlsbad under $3M with at least 3 bedrooms, 2 baths and 2000+ ESFk, and 4000+ ESF lot size

Average of 45 DOM, 34 Median

Keep in mind the Days on the MLS are not a complete reflection of market time as the clock resets for that listing when the property gets unlisted and then immediately re-listed. So the true market time is longer for many properties.

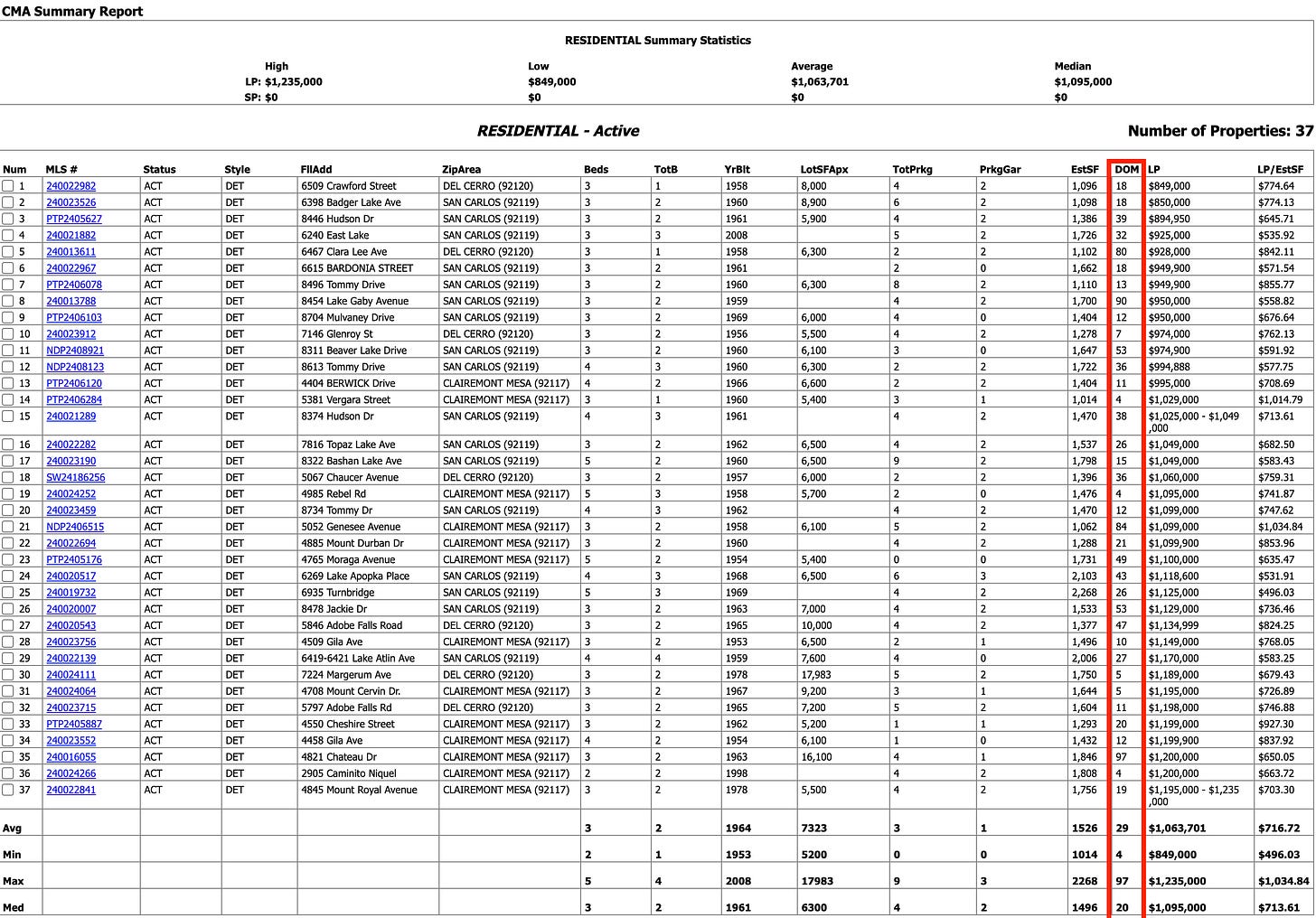

The under $1.2M market is selling better than higher price points in Clairemont, Del Cerro and San Carlos.

Average of 29 DOM, 20 Median

People are moving to the parts of America endangered by wildfires, flooding and extreme heat, even as those dangers become more frequent and intense.

America’s high-fire-risk counties saw 63,365 more people move in than out in 2023. Much of that net inflow was people moving to Texas. But the story differs from state to state; among California’s high-fire-risk areas, more people left than moved in. That marks a reversal from 2022, indicating that people may be growing more responsive to fire risk in the Golden State.

The nation’s high-flood-risk counties saw 16,144 more people move in than out. Florida drove a large share of the migration to high-flood-risk counties, but a smaller share than it did in 2022, indicating that people may be growing more responsive to flood risk in the Sunshine State.

If you are a Seller in a high fire zone, Buyers are more aware of these risks. If you are a Buyer, be strategic about where you buy or be prepared for home insurance costs to rise significantly.